How a Fintech Solution Can Succeed With Big Data Analytics

Learn how implementing a big data analytics solution within your Fintech application can improve your customer experience and boost ROI.

In 2017, FinTech has exploded. In the first quarter of 2016, fintech funding hit $5.3 billion – a 67% increase compared to the same period in 2015. And it continues to grow in 2017. Consumers now feel more encouraged to trust their money to 3rd party companies over traditional financial institutions.

As the funding is ripe and the consumer demand is active, more and more companies are venturing into this domain. Today, there are enough startups in this sector that it is becoming highly competitive. Obviously, to gain a good market share of consumer business, FinTech enterprises must be on top of providing innovative services and products to consumers.

So, just how does a FinTech company discover what types of products to offer to both individual and collective consumers? It has to engage in customer service data analysis:

- Mine data from lots of different sources and get that data organized into information that is meaningful.

- Use data to understand current consumer behaviors and predict future consumer behavior. This is known as predictive analytics.

- Use data to predict what a specific type of consumer might most likely purchase.

- Analyze data from both internal sources (current visitors and customers) as well as from external sources.

This data mining, coupled with the latest technologies in data science, allows businesses to understand their customers far more intimately and to provide products and services that will precisely meet their wants and needs.

Here’s a very simple example: suppose internal data shows that there is an “uptick” in visitors looking at renters’ insurance. External data suggests that there’s a rising demand for new accommodation as kids are moving in for the new college semester. When FinTech data analytics crunches all of this information, it is obvious that the company can improve its customer service by offering more and more varied rentals’ insurance options.

So, if you have been asking exactly what is customer service analytics, you now have at least a partial answer.

How Big Data Analytics Can Improve Customer Service in a Fintech Solution

Merely accumulating big data in FinTech is not an option. You will not survive by just collecting it. You will need consultants who can mine the data, offer comprehensive analytics consulting, and provide recommendations for the products and services your company needs to offer to the consumer.

Romexsoft has been in the business of customer data analysis for the FinTech industry for a number of years and successfully offered big data analytics as a service solution to several financial companies across different domains. In this post, we’d like to outline the options you may be missing within your product.

Using Predictive Customer Data Analysis in Wealth Management

Wealth management products are now in trend with the consumer demand steadily rising on a year-to-year basis. Traditional financial institutions are now forced to do the “catching up” and compete with more transparent, affordable and social web solutions and apps.

As Ernst and Young research on the matter puts it: “To a large extent, wealth managers understand client needs and wants, but there are a few important areas of divergence.” One of those areas of divergence stands for emphasizing the role of the advisor interactions while overlooking the impact of transparency when it comes to fees and portfolio management.

That’s just one area where Big Data could be leveraged to bridge the exciting gap between the customer expectations and the business anticipations.

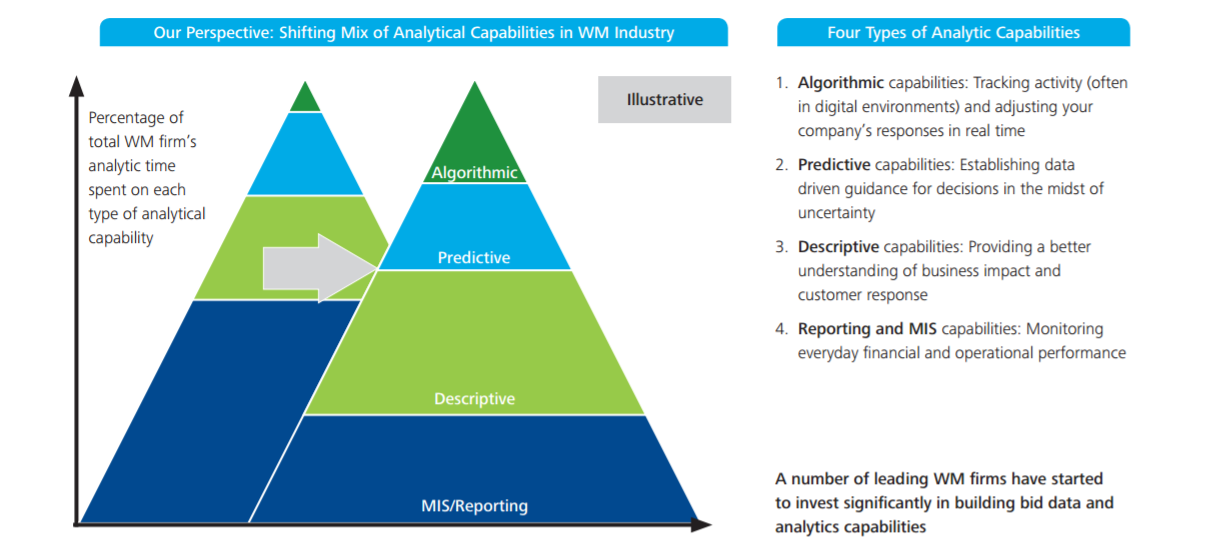

Deloitte suggests that wealth management companies should start leverage big data analytics within the next 4 areas:

Source: Deloitte

Let’s break these four areas further into the exact processes, which could be significantly improved with big data analytics services:

Customer Acquisition – external and internal data could be combined to create more comprehensive customer profiles. Segmenting your audience will allow you to create more personalized offers and entice the leads with razor-targeted propositions. An algorithm could be used to predict, for instance, which kind of additional services the user would like to purchase based on their on-site behavior or whether you should target a certain age group (25-35 years) with a certain product.

Customer Retention – imagine that you could leverage the customer’s social data and have it “crunched” into actionable insights. For instance, you can build an advanced prediction matrix, which would show you with high-accuracy want kind of products the user is interested in the most – setting up an early retirement plan; saving for college or saving for long-term wealth building.

Customer Experience & Service – by continuously studying the client’s browsing matters; habits and financial decisions, you can train the algorithms to generate real-time trade or investment ideas based on the current knowledge about the client. You can offer smarter options to rebalance their portfolios and in general, leverage various insights to offer them a truly tailored portfolio allocations without assigning a dedicated agent. In a nutshell, that’s how robo-advisors currently operate.

These are just a few examples of how data analysis can improve customer service for a fintech company. But there’s more to that.

Reducing Fraud Risk With Predictive Analytics

Fintech companies are put to higher standards when it comes to customer’s data security. On the other hand, fintech startups, especially those in the lending or debt management niche, need to protect themselves and their communities against fraudulent clients.

A comprehensive big data analytics solution could be embedded in operational processes and automatically active during live transactions to isolate and minimize fraud risks. First, you’ll have to “feed” the algorithm with historical data and train it to spot certain patterns:

- What distinguishes a normal transaction from a fraudulent one.

- Are there any identical or repetitive items such as location, date, threshold amount, etc.

- What are the key characteristics of a risky customer e.g. conducts a number of pennyworth transactions before a significantly large one etc?

A smart algorithm would be capable of creating a relationship matrix between hundreds of thousands internal and external data elements and assign each customer with a risk potential score (and/or isolate the at-risk segment). To minimize fraud risk you can also deploy the clustering model as part of your fintech data analytics model.

A clustering model will use all the data at hand in order to establish “clusters” (groups) of customers based on similarities in behavior, history with your brand and so on. For these clusters, you can then enable levels of varying thresholds and get notified whenever any of the risk actions occur. Additionally, you can adjust the “clusters” roles and permissions to smoothen the experience for reliable users and “tighten the ropes” for potential troublemakers.

Building New Gen CX Through Predictive Customer Analysis

Did you know that in 2016 the Consumer Financial Protection Bureau has received the record high volume of consumer complaints? Over 1 million of US citizens have voiced out their complaints on debt collection, mortgage terms, and credit reporting. In fact, financial companies of all shapes and sizes, including startups, get a fair share of negative reviews online.

Catering to each of that complainer personally might be hard. But you can leverage data you already have and use it towards tweaking your product further and leveraging customer experience onto a new quality level.

Here’s a quick predictive analytics case study to illustrate how to improve your customer service with Big Data. You can develop an algorithm that would source both structured and unstructured data (social media posts, comments, and reviews posted online) about your product, group the complaints into specific “clusters” and assign priorities for their resolution.

Additionally, you can leverage customer service data analysis and obtain insights from your customer support emails, survey responses, call center transcripts and other sources to identify the most pressing customer experience issues.

In fact, your predictive matrix can take at least four different factors into account:

- Customer behavior – payment history, transactions, usage history.

- Personal data provided – demographics, self-declared information, additional attributes.

- Overall sentiment – indicated preferences/needs expressed on 3 rd party channels; opinions shared online or privately with your company.

- Customer interactions – email support history, chat transcripts, call center notes and transcripts and more.

Digging deeper into your customer experience may even enable you to rethink your entire product concept and positioning. Take Metromile for example. This startup is now making waves in the insurance industry, offering more affordable insurance options for low-mileage drivers. The whole product concept was born from the negative sentiment about the obnoxiously high insurance rates for occasional drivers and extensive prior analysis of the drivers’ habits to work out the ultimate value proposition.

Big Data in Fintech is The “New Oil”

For the financial service industry, the value of customer data analysis cannot be overstated. The sector is becoming highly competitive, and only outsourcing big data analytics solutions will keep FinTech enterprises “in the game.”

Many owners are outsourcing their business analytics, in order to get the data and recommendations they need while they focus on other operations. It’s cheaper and more efficient to have consultants do the heavy lifting of the statistical analyses and then come up with solutions and recommendations.

These business use cases are reported to show you how using data analytics in customer service solutions can improve your FinTech product.

And if you feel interested in outsourcing Big Data to Ukraine, get in touch, and let’s have a discussion of your needs!