Serverless FinTech App Development With Real-Time Data

Discover how we developed a serverless solution capable of handling high volumes of data while staying cost-effective with cloud infrastructure.

Our Customer

Stock Trading Platform

Uptick Stocks was a US-based FinTech company that provided their users with a streamlined stock market experience. The Uptick Stocks application leveraged real-time stock market data and gamifies learning and practicing stock trading to gain the highest profit with no risk to their real budget.

The Challenge

Data Management and Cost-Optimization

Uptick required a solution to enable real-time stock price updates, calculate user portfolio value changes, and provide real-time UI stock graph updates. The ultimate goal was rendering a lifelike and dynamic trading experience while keeping the operational costs of the solution as low as possible.

The primary challenge was to develop a scalable solution capable of handling a high volume of data (both tracked stock prices and the changes of those prices) while remaining cost-effective in terms of the whole app’s cloud infrastructure expenditure.

The second challenge was that the solution needed to ensure minimized server spending during periods when the stock market was closed, to make the application’s cloud infrastructure cost-conscious and optimized for resource allocation.

The Solution

Scalable Real-Time Data Processing System

Steps that were taken to implement serverless backend for stock market app:

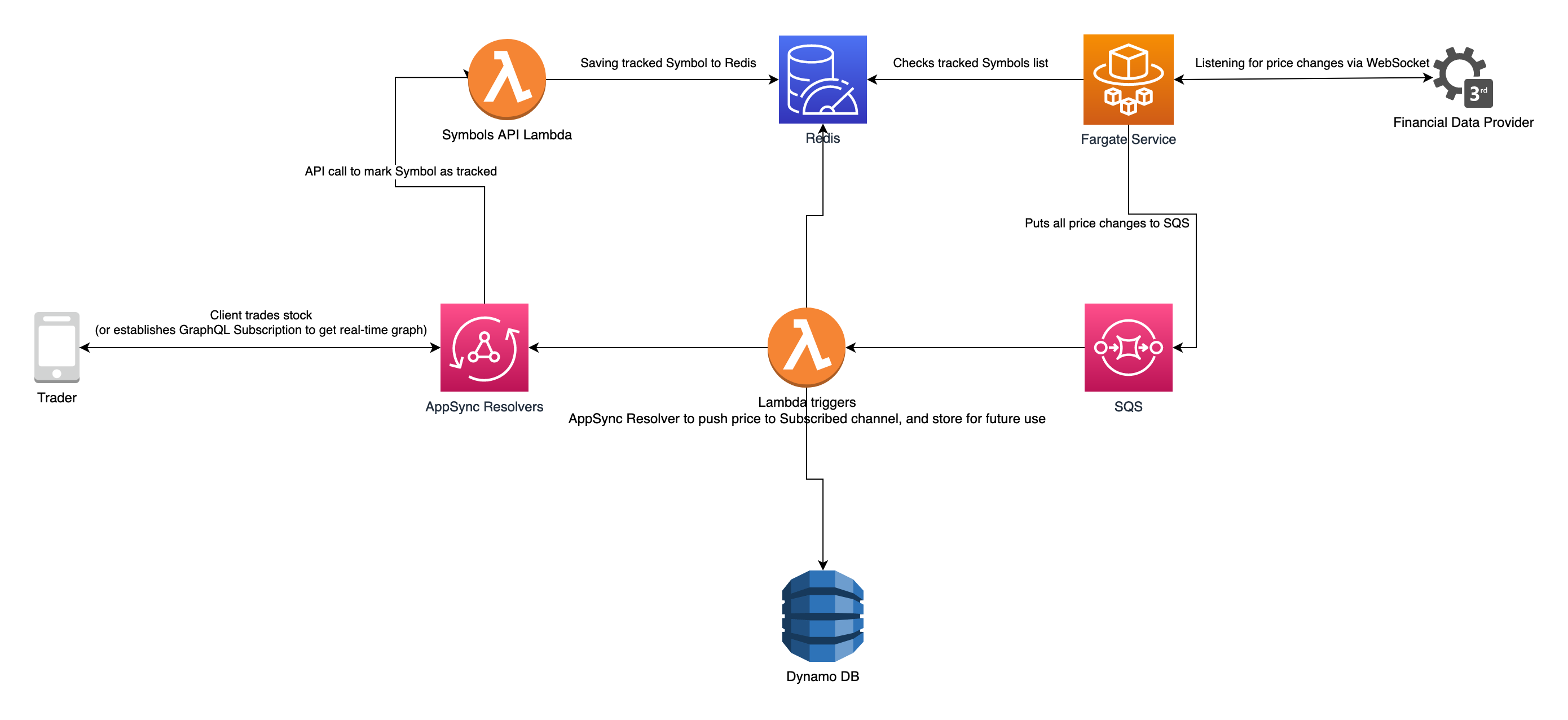

- Utilize AWS services, such as Lambda, AppSync, SQS, Fargate, and a 3rd party financial data provider, to implement an efficient and scalable solution for real-time data processing.

- Applied a decoupled architecture to process data asynchronously, ensuring that a failure in one event doesn’t affect others and thereby boosting the reliability of the application.

- Implement AWS Fargate service with web-socket connection to data provider so as to track price changes for required stocks.

- Develop an AppSync API for trading/tracking symbols, with Lambda running only when clients are using the app in order to ensure maximum efficiency of using servers capacity.

- Subscribe to web-socket changes and recalculate user portfolios when clients trade stocks, triggering recalculation of AWS Lambda via SQS Event. This allows scalable, on-demand data processing.

- Establish GraphQL on-demand functioning subscription for providing real-time graph data, fed by data through AppSync Mutation Lambda. If no users are interested in particular stocks, there is no triggering or storing of data, which minimizes operational costs.

- Used IAM roles, encryption, and network isolation to protect and process financial data and users information

Diagram of Serverless Architecture of FinTech App with Real-Time Data

The Results

Enhanced User Engagement Through Real-time Trading Simulation

Based on the implementation we’ve provided, here are two substantial goals that were achieved by Romexsoft’s solution developed for Uptick:

- Providing a realistic and dynamic trading experience for end-users.

- Keeping application’s operational costs low.

Uptick’s major goal was to provide its users with a mobile learning app for trading that would enable them to buy stock with virtual money and take part in challenges with other players.

By implementing a solution that supplied real-time stock price updates, portfolio value changes, and real-time UI stock graph updates, Uptick was able to deliver a dynamic and engaging trading experience to its users.

Another important goal achieved by the solution was to keep operational costs low. By leveraging AWS services, such as Lambda, AppSync, SQS, and Fargate, the solution was capable of processing a high volume of tracked symbol changes while remaining cost-effective.

Additionally, by ensuring that server costs were minimized during periods when the stock market was closed and by establishing GraphQL Subscription, which works only on demand, the solution enhanced operational cost minimization, which is a key consideration for any business.

Why Romexsoft

AWS Serverless FinTech Architecture Partner

Our company is an AWS Advanced Tier Services Partner specializing in serverless FinTech application development and cloud architecture engineering on AWS. We built real-time trading platforms with on-demand processing and a cost-optimized serverless infrastructure.

Beyond core serverless backend development, we provide:

- Third-party data integration to establish external financial market data streams

- In-memory data layer implementation for low-latency real-time calculations

- SQS-based asynchronous processing to isolate app failures under high event load

- IAM, encryption, and network isolation for secure financial data handling

- Infrastructure cost optimization aligned with stock market operating hours.

Serverless FinTech App Development FAQ

Event-driven architecture uses AWS services like Lambda, SQS, and AppSync to respond instantly to stock price changes or user actions. This approach ensures real-time performance and eliminates unnecessary computation when no market events occur.

A scalable trading backend relies on stateless Lambda functions, asynchronous event queues, and caching layers like MemoryDB. Together, these ensure the system can handle thousands of real-time updates without performance degradation.

We design architectures using AWS-native auto-scaling, asynchronous event handling, and modular functions. This enables each component to scale independently, ensuring consistent performance as user activity or market data volume grows.

AWS pay-per-use model ensures you pay only when functions or containers are active. By combining Lambda and Fargate, we minimize idle-time spending and reduce operational costs during market closure or low user activity.

Reliability and resilience can be maintained by using AWS-managed services like Lambda, DynamoDB, SQS, and API Gateway that automatically handle scaling and redundancy.

DynamoDB provides fast and reliable data storage with built-in replication across Availability Zones, while API Gateway manages API traffic securely and ensures consistent performance under load. By designing the system around events and keeping components decoupled with SQS or EventBridge, each part can work independently and recover quickly if something goes wrong. Using stateless Lambda functions and CloudWatch monitoring helps the app stay stable, respond fast, and handle traffic spikes smoothly.