Fintech vs Banks: Cooperation or Competition?

One of the hottest trends among investors in 2016 is Fintech related ventures. The industry simplifies and transforms financial operations between people, companies and countries. Young startups with “Silicon Valley” mindset bring serious competition for banks, targeting unbanked population and it’s only the start of upcoming tech disruption of traditional banking.

Fintech Startups – how it all started?

Back in 1994, Bill Gates said that banks are like dinosaurs and the world needs banking services but not necessarily banks.

Banks, as we know them, have been around for centuries and held the monopoly on finance services. Despite the huge role of banks in the development of modern capitalist civilization, there is still plenty of room to innovate and provide better products. Unfortunately, history has taught us that not giving enough attention to banking regulation could cause a great cataclysm in whole world’s economy such as 2007-08 financial crisis did. As a result, today banks often show a lack of innovations either because of their stable market position or due to complex government regulations.

The whole banking system relies on communication. There are core communication links like Customer-Bank, Bank-Bank, Government-Bank. Integration of the internet in banking operations back in 1995 provided a wide range of benefits such as fast transactions, 24-hour permanent access from anywhere, immediate consultation, remote account opening,managing and much more. Online banking has become the industry standard.

Nowadays Internet is still shaping banking with the help of mobile technologies, which are making customer’s interaction with banks more personal, frequent and smart. An imperfection of banking system has inevitably drawn the attention of Silicon Valley community to it. Also development of online business has built the ground for non-banking online-payments solutions, where companies like PayPal took advantage and overcame traditional financial institutions.

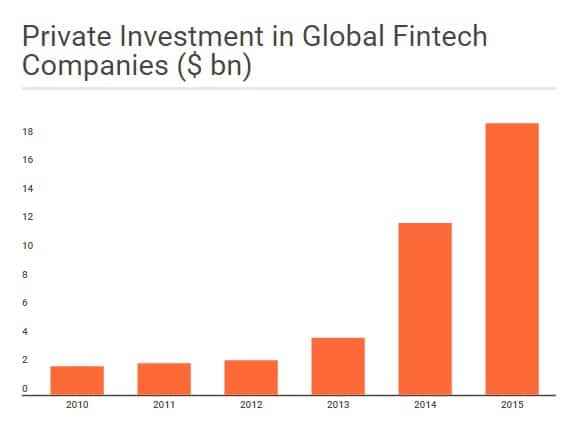

As the result, amount of investments in fintech companies has grown exponentially in recent years.

Source: Citi and CB Insights; Includes first around and subsequent private investments

So what is Fintech? It happened that fintech is an industry where small to medium young companies utilize latest technologies to create innovative products in such a conservative sector as a financial industry. A so-called fintech startup often consists of several tech professionals with industry expertise and revolutionary idea, enthusiastic and passionate approach.

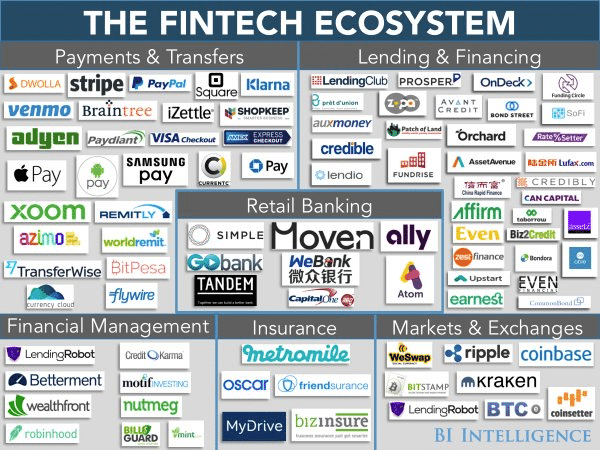

Areas of the most intensive fintech innovation include:

- Online/mobile payments

- Money transfers

- P2P Lending, Crowdfunding

- Asset Management and Wealth

- Insurance (InsurTech)

- Investments (Robo-advisors)

- Digital Security

- Big Data Analytics

- Digital Currency and other Blockchain technologies

Not all players on the fintech market are startups. Over the years some companies have become established giants. Take as an example PayPal (IPO in 2002) with a valuation over $50bn and Ant Finance (launched Alipay in 2004) worth over $60bn.

Fintech 2016 is presented by such top companies:

- PayPal

- Alipay

- Klarna

- Square

- BitPesa

- Lending Club

- OnDeck

- SavvyMoney

- Lendio

- Credit Karma

- LendingRobot

- BTC and more.

Also it is important to mention UK and London Fintech ecosystem. According to this year’s research, more than $5,5 bln of investments were made by top fintech startups between July 2015 and January 2016.

Source: BI Intelligence

What are the consequences for banks and how they react

There are some key background conditions that have led to a major fintech disruption of banking industry and they vary in different countries:

- High national Internet and mobile penetration.

People in developed countries, especially those of Y generation, eager for digital and mobile solutions for their everyday activities. Fintech innovations provide them with flexibility, increased free time and more convenient customer experience.

- Large e-commerce systems with Internet companies focused on payments.

Such giants as eBay and Aliexpress have supported the growth of PayPal and AliPay, that became big competitors for banking payments, especially in China.

- Obsolete traditional banking system.

Today there are more than 2 billion of unbanked population. For some people regular banking is too expensive and mobile financial services provide cheap remote access to accounts, savings and loans, which can also lead to overall economic growth.

- Government regulations.

Some countries like Nordics, UK and, even, Kenya are known for adaptation of their legislation to utilize benefits of fintech finance services and to support their growth.

- Extensive implementation of cutting-edge technologies.

Latest technologies allow us to make banking more efficient, more personal, cheaper and easier to access. Development of Big Data science and analysis, internet coverage, Machine learning and AI, biometrical technologies, fintech blockchain, quantum computing, even VR and AR will completely change financial institutions from as we know them now.

No doubt that banks are strongly affected by Fintech expansion and it’s only the beginning. For now Fintech digitalization successfully replaces physical assets of banks.

Nordic banks have already halved branches since 2008-2009. A number of full-time staff is also constantly decreasing. On the other hand, the strong position of Nordic banks could also be an obstacle for innovations. Not seeing major competition from Fintech players could cause significant loss of opportunities and slower client acquisition.

The Nordic banks are on average about ten years ahead European banks which are in turn about five years ahead the US banks. Banks in developing countries are increasing their physical presence (South and Southeast Asia). Number of branches is growing in Indonesia, but also a digital banking program was launched in 2015 to reach out to the unbanked. New regulations allow tech intermediaries to spread banking services. US branches in large cities are also growing. One of the reasons is client acquisition when many banks due to regulations require physical presence to open an account.

Today banks are changing under the influence of new technologies and innovative finance market players. Some banks are acquiring Fintech startups to enhance their services. Some invest in young companies or create own startup accelerators to support new technologies and benefit from them. Biggest banks such as Bank of America, Citigroup, Goldman Sachs, JPMorgan Chase, Morgan Stanley, and Wells Fargo have made significant investments in 30 fintech companies since 2009, according to CB Insights data. And some banks created strong R&D departments to produce their own solutions to take part in modern innovations marathon.

How relationships between fintech companies and banks will shape the future of finance

We are now only at the beginning of complete technological disruption of traditional banking. Young innovative companies created by people who grew up with internet, mobile phones and smartphones are shifting paradigms in all areas of our life, including finances.

Will banks disappear in future? As we know them now – definitely. As institutions – unlikely. For now, startups in Fintech group have taken less than 5% of consumer banking revenue and it probably won’t be higher than 10% in an upcoming decade. Theoretically, each service that banks provide could possibly become the basis to a new startup. But as long as banks dominate in their core areas of lending, investing and deposits they will keep their respected and trusted market positions.

Banks vs Fintech is competition or cooperation?

It’s both. Some of startups could help banks significantly reduce their operational costs like digitalization helped with spendings on full-time staff and physical branches support. Some Fintech companies will provide serious competition like online payments and P2P lending does.

There are some huge innovations that are going to change completely not only our financial operations but the whole life. And one of them is Blockchain, which is definitely on the verge. Blockchain is the technology behind famous Bitcoin cryptocurrency. It could replace the current centralized payment process with a distributed network for many aspects of financial services, especially in the B2B world. Blockchain positives are decentralization, programmability, and immutability. It could also transform many existing legacy systems that are stable but may not be the most cost or capital efficient way of doing business.

So where is the financial (r)evolution going? Some developed technologies which are available for quite a long time like Mobile, Cloud, Social networks and Big Data are being continuously integrated into financial services all over the globe. They improve various aspects of banking like distribution, payments, products, risks management and, even, marketing. Most of the changes would be about improving customer experience and shifting from product-oriented models to client-oriented.

Do you want to become the next market disruptor, but don’t know where to start from?

Romexsoft has experience in development of Fintech solutions and will provide high-level expertise in creating innovative financial products to support global banking evolution.