How to Build Your Own Crowdfunding Platform

Helpful takeaways for building your own crowdfunding platform:

- Understand the importance of a clear business model: Whether it's donation-based, rewards-based, or equity-based, your choice will shape your platform's functionality and legal requirements.

- Technology matters: From web servers to payment gateways, the tech stack you choose will play a crucial role in the user experience and security of your platform.

- Trust is key: The right payment gateway not only ensures smooth transactions but also builds trust, which is vital for attracting both campaigners and investors.

Traditionally, getting a business financed was a matter of asking a few investors for capital. In return, these investors were either given a return on their investment or equity positions in the company.

Yet enter crowdfunding – a concept that has turned the traditional investment process on its head. Now small startups, charities, and pretty much any individual with an idea can use the Internet to appeal to a large group of potential funders, each of whom contributes a small amount toward the goal.

If you have thought about expanding your investment portfolio, crowdfunding may be a business you want to pursue:

- The concept is now hugely popular, and you stand to make a fair amount of profit if you can set yourself up as trusted and reputable for both investors and campaigners. Kickstarter, for example, takes a 5% “commission” on all funding that comes in.

- As of January 2016, Kickstarter had 101.1 million users, pledges of $2.3 billion, and over 100,000 projects were funded to date. Interestingly, 3.1 million investors were repeaters.

Granted, Kickstarter is the “gold standard” of crowdfunding, and you may not have your own crowdfund software solutions sights set that high. Still, if done right, crowdfunding is a great business.

To get started, you have many decisions to make, including your business model and exactly how to create a crowdfunding platform to suit that model. Yes, it is a website, but a complex one with many functions and elements. Here are the stages you are likely to pass through.

Table of Contents

Define Your Purpose For Starting a Crowdfunding Website

Your purpose must be clear in your mind before you begin to think about building your own crowdfunding platform.

Indiegogo began strictly for the film industry, but, within a year, had scaled to accept campaigns from any creator, with 24 categories for funding. Kickstarter, for example, invites campaigners with virtually any funding need at all. It has 15 categories, but those cover almost any project a campaigner could think of. Most popular and successful projects tend to be in technology, games, and design.

There are also many variations of crowdfunding now. For instance, peer-to-peer (P2P) lending (or crowd-investing) is on the rise – small entrepreneurs pitch their ideas to small investors (sometimes as low as $25 each), who loan the money with an expected return with interest.

Patreon allows content creators and artists create reward plans for their supporters and receive monthly donations.

You may want to stick to a certain theme e.g. only educational-related projects or funding female-led businesses; supporting artists and online content creators or aspiring tech inventors.

The more creative you can get with your concept, the more attention you may receive after the launch.

Decide On Your Business Model

To start a crowdfunding business, you must first determine which business model is the best for your purpose. There are three broad categories of crowdfunding models:

Donation-Based: this will probably not be a model for you, for it is really set up for community-based and charitable causes. Donors contribute to campaigns with no expectation of any return, and the platform owners generally take only a tiny percentage of administrative costs.

Rewards-Based: This is really a variation on donation-based funding, except that the investors receive some reward – usually in the form of a product or service for which the campaigners are seeking the funding. For small investors, this is usually enough of a reward to pony up some funding. In this case, your campaigners will be promoting their businesses, showing off their product or service, and asking for small amounts from many people. A good example of this type of platform is Fundable. As the platform owner, it is well within the common practice to charge a fee of 5%.

Equity-Based: This is more like the traditional investing model. Investors usually pony up larger amounts of money and are given an equity position in the campaigner’s business or at least a financial return on their investments. This is a good model when you anticipate that there will be large investments for the types of projects you will be hosting. There are legal implications here too – you will need formal agreement templates and an understanding of investment and tax law. Most equity-based crowdfunding will require business licenses as well, depending upon a geographic location of the headquarters.

Other Details of Your Business Model

Kickstarter funds no project unless that project has reached its financial goal. Investors fund through pledging, and those pledges are then “called” when the goal is reached. Indiegogo, on the other hand, is more flexible and offers both partial fundings, as the money comes in, or the all-or-nothing model. Other decisions will include such things as:

- Number of campaign days.

- Registration rules.

- Your own video hosting or the use of a 3rd party, like YouTube or Vimeo.

- The types of customer service and support for campaigns you will provide.

- What countries will be eligible?

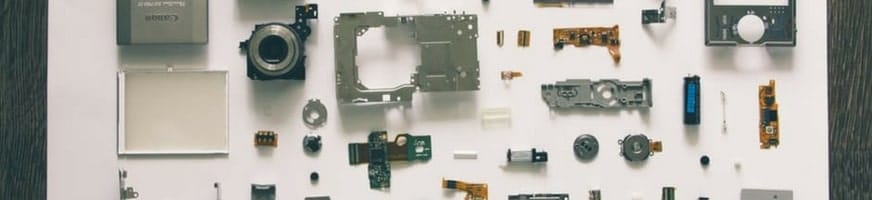

Settle on The Right Technologies

If you are trying to figure out how to start a crowdfunding website like Kickstarter, you are in for some pretty high-end development. The crowdfunding technology stack is massive, including:

- Web servers

- Name server providers

- Email services

- Hosting providers

- SSL certificates

- Frameworks – Spring/Struts 2 and J2EE

- Analytics and Tracking

- JavaScript libraries

- Audio/Video Media

- Payment Providers

- Mobile optimization

- Widgets

- Content delivery networks – cloud based, including AJAX Libraries API for popular open source JavaScript libraries

- Aggregation functionality – such as Atom

- Document Information – mostly JavaScript

- Encoding

- CDN providers

- Language translation software – for platforms with a global reach

- CSS media queries

Even if your crowdfunding platform will not be on the scale of Kickstarter, most all of these elements and functions will need to be present to some degree. You cannot afford to leave anything out even for the sake of keeping the overall cost to develop a crowdfunding platform at bay.

Crowdfunding Website Features

As you think about how best to build a crowdfunding website, you should ask yourself the following questions:

- How inviting and user-friendly is your site?

- Do you have dedicated sections so that each project can be showcased and a CMS that allows potential funders easy navigation?

- Are there built-in methods for potential funders to ask questions of creators and of you?

- Do you have special pages that recognize and reward funders, so that potential investors can see them and develop trust in you?

- Do you enable creators to communicate directly with their funders and keep them updated?

In terms of website features that could be translated to:

- Powerful management system to manage, create, edit and post crowdfunding project updates.

- Q&A/comments page, where backers and project creators can exchange thoughts.

- An exclusive, investor-only area where the creators will share special updates/rewards with them to create a feeling of specialty and recognition for their donation.

- Social media profile integration for simple registration and content curation. For instance, auto-sharing project updates to Facebook/Twitter/Instagram.

- Intuitive website navigation, advanced project search, and well-curated categories. You should also consider the project moderation/verification process to avoid turning your platform into an editorial board.

- Project management and reporting functionality – data related to backers, investors and project stats is important for creators. Your admin panel should include real-time data and report generation functionality, facilitate sharing project updates with investors, manage rewards, funding period and other project settings.

Our crowdfunding platform developers can advise you further on the features worth implementing in the first product version, and those that could be rolled out with the next update.

User Engagement and Community Building: How to Set Up Crowdfunding for Success

After you’ve determined the features essential to build a crowdfunding platform, the next pivotal step is user engagement and community building. A platform with advanced features won’t thrive without an engaged user base. Here’s how to create a crowdfunding platform that not only attracts but also retains users.

Importance of User Experience

When you build a crowdfunding platform, a seamless user experience is vital. Ensure your website is user-friendly and that the journey from discovering a project to investing is straightforward. This will not only encourage more people to invest but also make them repeat users.

Community Building Strategies

Community building is crucial when you’re figuring out how to set up crowdfunding successfully. Implement forums, enable social media sharing, and offer regular updates on projects. These strategies will keep your existing users engaged and attract new ones.

User Retention Techniques

To retain users on your crowdfunding platform, employ techniques like email newsletters, rewards for frequent investments, and personalized project recommendations. These strategies make a user feel valued and more likely to return.

Feedback Mechanism

A robust feedback system is essential when you’re learning how to create a crowdfunding platform that meets the needs of your community. Continuous improvement based on user feedback ensures you meet the evolving demands of your audience.

Why Engagement Leads to Payment

An engaged community is more likely to trust your platform, making them more inclined to proceed to the payment stage. This trust is invaluable and sets the stage for the financial transactions that are the backbone of your platform.

Choose The Right Payment Gateway

With an engaged community in place, the focus now shifts to the financial aspect. The best crowdfunding site in terms of appeal, design, and development will go nowhere unless both funders and recipients have trust in the flow of the money. Choosing the right payment gateway is one of the most important decisions you will make. There are two common payment methods – all-or-nothing and partial models.

Kickstarter uses the all-or-nothing model. Unless a project is fully funded, payment is not made. This method involves collecting pledge cards rather than actual payments and is preferred by investors – their money is not given until the goal is met and they have better faith that the project will proceed. Once the funding goal has been met, the pledge cards are “called.” One problem with this method is that some of those pledge cards may not be honored in the end. This can be devastating for a startup that needs every pledged penny.

The partial payment method involves collecting the money up front and awarding at least some funding to a project, even if the financial goal has not yet been met. Indiegogo uses this method. One word of warning here: investors are hesitant to go this route unless they fully trust the platform owners, and this takes time.

Two Primary Online Payment Gateways

WePay: this service provides the essentials for both types of payment models. Advantages of this provider include the ability to adjust settings to match your specific procedures – escrow times and durations, for example. It’s a good choice for individuals who are operating their own platform. Processing fees are similar to other models, but you decide who pays those fees.

PayPal: Obviously the most well-known and trusted gateway, this is the preferred method of most donors and recipients. PayPal also has a customized API for such things as disbursement delays, mass refunds, etc.

We’ve previously written a massive guide about payment integrations and compared different payment providers. Go check it for more insights.

Are You Ready to Build?

People who build crowdfunding platforms have a passion for their purpose. It may be to improve the environment, to help those in need, or to give small business owners a fighting chance. When it comes to the actual building, however, they can become thoroughly overwhelmed with the decisions to be made and with the details of design and development skills they realize they may be lacking, even with “canned” solutions that still need customizing.

So why not start from scratch with a software development company like Romexsoft that has vast experience in developing crowdfunding websites/platforms?

Building your own crowdfunding platform FAQ

Crowdfunding platforms have unique challenges and opportunities, such as the need to balance the interests of both project creators and investors. They also require specific features like secure payment gateways and a robust vetting system for projects.

While having a technical background can be beneficial, it's not strictly necessary. Many successful crowdfunding platforms have been built by teams that include both technical and non-technical members. The key is to have a clear vision and to choose the right technologies and partners to bring that vision to life.

Both approaches have their pros and cons. Building from scratch offers more customization but is often more time-consuming and costly. Using an existing solution can be quicker and less expensive but may limit your platform's unique features. The best approach depends on your specific needs and resources.

Security is a top concern for any online platform that handles financial transactions. Make sure to choose a reputable payment gateway and consider additional security measures like SSL certificates and data encryption.